The BOOTE editorial team receives an average of two to three enquiries about VAT every month. The basic problem is always the same: a used boat is to be bought or sold from or to a private individual. The dilemma: There is no proof that the boat has at any time paid the VAT (this is the correct tax term for VAT) or import VAT (this is due if the boat is imported into the EU from a non-EU country) that is due in the EU.

However, the tax authorities make this mandatory. The "Information sheet on German customs regulations for skippers of watercraft" from the Federal Finance Directorate North states: "Water sports vessels that are to be used within the member states of the European Union and by persons resident there must be in free circulation under tax law, i.e. the VAT for old vessels must have been paid in one of the EU member states. Appropriate proof of this must be presented at the request of the customs authorities." This raises two questions:

- Does the obligation to provide proof apply to all end-of-life vehicles?

- What is suitable evidence under tax law?

Are all used cars a tax case?

The obligation to provide evidence does not apply to all end-of-life vehicles. The relevant Council Directive 92/111/EEC of 14 December 1992, the so-called

14 December 1992, the so-called "Broom Directive", which came into force on 1 January 1993, stipulated that watercraft put into service before 1 January 1985 should in principle be taxed. In countries that joined the EU later, the following dates apply to the tax exemption of end-of-life vehicles: Sweden, Finland and Austria before 1 January 1997; Poland, Hungary, the Czech Republic, Slovakia, Slovenia, Malta, Cyprus, Latvia, Lithuania and Estonia before 1 May 1996; Bulgaria and Romania before 1 January 1999.

What is suitable evidence?

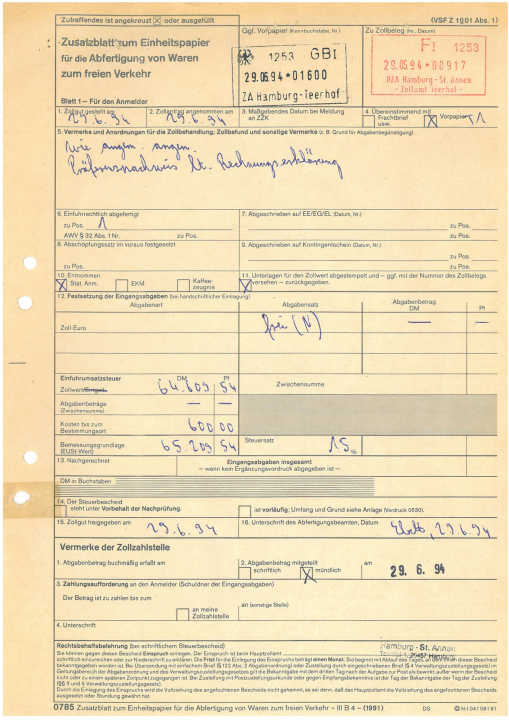

The question of what the tax authorities understand by "suitable proof" of VAT paid is particularly tricky. The dilemma begins with the fact that there is no standardised document that is valid for all EU member states. It is undisputed that sales invoices from a dealer with VAT shown and customs clearance documents showing the import VAT paid (for imports from third countries) are recognised proof that a water sports vessel is in "free circulation under customs and tax law".

A certificate from the manufacturer or supplier stating that the VAT has been paid can also be recognised as proof. However, according to the Federal Tax Authority, "... it must always be determined on a case-by-case basis whether the respective documents can be recognised." A declaration by a private individual, for example a previous owner, that the VAT was paid at some point is definitely not sufficient. This does not help even if such a passage is included in a private purchase contract.

There are also "historical" reasons why it can be difficult to provide reliable evidence. When the aforementioned "Broom Directive" came into force on 1 January 1993, thousands of boats belonging to EU owners became taxable virtually overnight. These were boats that had been put into operation after 1 January 1985 and that were legally stationed in an EU member state (but not in the country of residence) at the time they came into force - but had not been taxed until then. For example, the boats of German owners in France, Italy, Spain, the Netherlands, etc.).

Anyone who had paid the VAT due in another EU country at that time naturally received corresponding proof of this from the customs office, namely the so-called "Single Administrative Document" with a customs endorsement. Owners who were able to prove that their boat had been put into operation before 1 January 1985 by means of purchase invoices or, alternatively, insurance documents, invoices for repairs or materials, mooring fees or a dealer's or shipyard certificate, remained exempt from VAT. Unfortunately, however, even without a corresponding receipt from the tax authorities, it is not possible to prove that the boat was in free circulation under customs and tax law on the cut-off date.

And because such a notice from the tax authorities was and is not provided for, all kinds of "replacement certificates" for these old boats have remained the only proof to date that the VAT could be regarded as "paid" in 1993. However, many of these boats are now in 3rd or 4th hand ownership, and the tax-exempt certificates from 19 years ago have long since disappeared. So how can you still prove today that the classic car has been in free circulation under customs and tax law since 1993?

The problem becomes even clearer if we take the example of Slovenia, which joined the EU on 1 May 2004. On this date, all untaxed boats of EU owners stationed in Slovenia that were put into operation before 1 May 1996 remained exempt from VAT.

Now the case: In 2005, a German owner sells his boat, which has been in Slovenia since 1995, to a German buyer in Germany. Does the buyer remember that he now has to prove that the boat was stationed in Slovenia on 1 May 2004 and was put into operation by the previous owner before 1 May 1996 in order for the boat to move freely for tax purposes?

Hardly. Even if this may still work for the second owner, most of the "traces" will have been erased by the third or fourth owner at the latest, and it will be extremely difficult to provide evidence of this kind. After all, who carries around logbooks, naval invoices, shipyard and other documents from a whole gallery of previous owners in their household?

A lifeline: statute of limitations?

The problems described make it clear that there are many used boats on the market for which clear and unambiguous proof of VAT can no longer be provided. For the Federal Finance Directorate, this means: "If the evidence submitted does not show that import VAT or sales tax has been paid for the recreational craft, this means that customs duties and import VAT can be levied during a customs inspection. ... In the event that the skipper is unable to prove that the recreational craft is in free circulation under customs and tax law, customs duties and import VAT will be imposed on the skipper".

However, this is not possible until "the day after tomorrow", but is tied to legally prescribed assessment periods. These are four years for VAT in accordance with Section 169 of the German Fiscal Code (AO) and three years for import VAT in accordance with Article 221 (3) of the Customs Code (CC). However, the assessment period is extended to ten years if tax has been evaded and to five years if the tax has been recklessly reduced.

As we will show using the example of a judgement by the Berlin Regional Court from 2011, the "lifeline" of the limitation period for assessment is by no means always a safe haven for the tax debtor.

A classic case

The case of a private used boat purchase heard by the Berlin Regional Court in 2011 is a prime example of the situation in which many buyers and sellers of "untaxed" used boats find themselves. "Untaxed" is in inverted commas here because it is often not even certain whether a boat is "in free circulation" or not. But the case described above (GZ 20 O 378/10) shows us how things can go when there is no proof:

In September 2009, Jens A.*, who later became the plaintiff, bought a used motor yacht from Heinrich B.*, who later became the defendant, for the price of 105,000 euros. In the purchase contract, it is agreed, among other things, that the seller must provide the buyer with a certificate of the VAT or import VAT paid. At the time of this agreement, it was known that the boat had originally been purchased in the Netherlands by Gerd S.* from Berlin in November 1997, built in 1998/99 and delivered to Germany in 1999. In the contract with the shipyard, the first owner Gerd S. undertook to pay tax on the purchase price to the tax office in Germany no later than ten days after taking delivery.

In May 2002, Heinrich B. purchased the boat from Gerd S. as the second owner without ever having received a certificate from the latter confirming the VAT paid. After Jens A., as the third owner, bought the boat from Heinrich B. and insisted in vain in two letters from a lawyer that the agreed tax certificate be handed over, he sued the seller and applied to the court for the following:

- order the defendant to provide him with a certificate of the VAT and/or import tax paid on the vessel ...;

- in the alternative, declare that the defendant is obliged to compensate him for all damages incurred by him or his legal successor as a result of his inability to produce a receipt for the VAT and/or import tax paid;

- most alternatively, order the defendant to provide him with an exemption certificate from the Berlin Main Customs Office, according to which the Berlin Main Customs Office confirms that "... neither value-added tax nor import tax is required with regard to the ship."

The defendant Heinrich B. requested that the action be dismissed and claimed that the first owner Gerd S. had declared to him that he had paid the VAT. Furthermore, he is of the opinion that the plaintiff can no longer suffer any damage as a result of not being able to submit a corresponding certificate, as a tax assessment is no longer possible due to the expiry of the assessment period pursuant to Section 169 AO.

The judgement

The initial situation of this case is a classic in the daily used boat trade between private individuals with regard to VAT problems. The judgement is therefore of great significance for future buyers and sellers of boats without proof of VAT. The Berlin Regional Court finds in favour:

"It is established that the defendant is obliged to compensate the plaintiff for all damages incurred by him or his legal successor as a result of his inability to produce a certificate of VAT and/or import tax paid in respect of the vessel ...".

The court considers this claim of the plaintiff to be justified by the purchase contract, in which the defendant "undertakes to hand over the import tax certificate." And further: "The fact that he cannot hand over this (certificate) to the plaintiff is his responsibility, because he should have already taken care to obtain the corresponding certificate when purchasing the boat ... and otherwise should not have committed himself to the plaintiff in the purchase contract at issue.

otherwise he should not have undertaken to hand over such a certificate to the plaintiff in the purchase contract in dispute".

The justification

That is quite clear. However, the court also clearly rejected the application by the defendant Heinrich B. to dismiss the claim on the grounds that the assessment period had been exceeded:

"Ultimately, however, it is not necessary to decide whether an assessment limitation period has actually already expired in accordance with Article 221 of the Customs Code (CC) in conjunction with Section 169 AO. This question is to be decided solely by the tax assessment authority. Even if the ... court were to come to the conclusion that the 10-year limitation period for assessment under Article 221(4) of the CCC had already expired, the assessment authority would not be bound by this decision. In order for the action for a declaratory judgement to be justified, it is ultimately sufficient that there is a reasonable possibility that the claimant will be required to pay the VAT and/or import tax and then cannot prove that this has already been paid. On the one hand, the claimant would then have to prove that an assessment limitation period has already expired. However, the defendant cannot impose the corresponding burden of proof on the claimant. In addition, the plaintiff would have to prove that the ship was operated in the European Community during the entire limitation period. The plaintiff is unlikely to be able to prove this because he did not even own the ship during the first years of this period. On the other hand, the statute of limitations does not always run to the day after three ... or ten years, ... whether the subsequent collection of duties is inadmissible in an individual case due to the occurrence of the statute of limitations must always be examined specifically in the individual case, so that from today's perspective it cannot be ruled out that the plaintiff will suffer damage due to the non-availability of proof of payment of VAT/import tax, which the defendant will then have to compensate. In view of the fact that the plaintiff cannot resell the ship without the corresponding certificate of proof, the defendant is obliged to compensate the plaintiff for the damage that may arise as a result of his legal successor taking recourse against him in this respect."

The consequences

There is a lot to learn from this judgement:

- Do not buy a used boat for which no turnover or import VAT certificate is available.

- If you do so anyway, it should be agreed in the purchase contract as a precautionary measure that the seller is liable for all damages incurred by the buyer and his legal successors due to the fact that the corresponding evidence is not available or cannot be provided.

- A buyer should not rely on the statute of limitations from the outset, even if the age of the boat could indicate that it has expired. Before concluding the purchase contract, you should always involve the assessment authorities such as customs and/or the tax office in order to obtain a final judgement as to whether the boat still has to be taxed or is already in free circulation due to the expiry of the assessment period.

Last but not least: Croatia

Croatia will join the EU on 1 July 2013. One of the consequences of this will be that thousands of EU owners (in this case mainly Germans, Austrians and Italians) whose boats are stationed in Croatia untaxed on this date will become tax debtors virtually overnight. VAT will become due, without which it will not be possible to use the boat freely in the EU, to which Croatia will then belong.

At present, we are not yet aware of the Croatian implementing provisions on the collection of VAT due. However, based on experience with other accession countries and the EU's basic directives on VAT, the following principles can be assumed:

- The VAT rate due will correspond to the Croatian VAT rate, which is currently 23%.

- The amount of VAT due will therefore be 23% of the customs value of the boat. The customs value usually corresponds approximately to the current value (market value) of the boat at the time the tax liability arises.

- In analogy to the procedure in other accession countries, all boats that have not yet been taxed in the EU and were put into operation after 1 July 2005 will be subject to tax.

- Accordingly, all boats that were put into operation before 1 July 2005 remain tax-free. Corresponding evidence must be submitted to the fixing authorities.

- All boats for which VAT was demonstrably paid in an EU country within three years prior to the date of accession also remain tax-free. If the EU VAT payment was made before 1 July 2010 (three-year period), the boat is only exempt from VAT if it can be proven that the boat left Croatia within the previous three-year period and entered an EU country (e.g. Slovenia or Italy). Otherwise, the boat has lost its "Community character" and must be re-imported into the Community, i.e. taxed.

- Boats owned by EU citizens that were imported into Croatia prior to EU accession by paying Croatian import VAT also remain tax-free.

Boats from a third country

In principle, import VAT is due for every boat that is delivered (imported) into the EU from a third country (non-EU country) - regardless of when the boat is put into service, i.e. regardless of whether it is a new or used boat. The tax rate corresponds to the VAT rate of the importing country (i.e. 19% in Germany). The calculation is based on the customs value (see above). Important to know: The transport costs incurred for deliveries must also be taxed.

Caught in the act

The Federal Directorate of Finance explains refreshingly clearly what actually happens under customs and import VAT law if it is established during an inspection that a recreational craft is not in fact a "Community good", i.e. a boat that has been brought into the customs territory of the Community untaxed (and duty unpaid). In such a situation, according to the Financial Directorate, "a customs debt is regularly incurred as a result of the irregular introduction of goods into the customs territory of the Community. The person who physically brought the goods into the customs territory of the Community becomes the debtor. In addition, the person who acquired or was in possession of the goods in question may also become a debtor if they knew or should reasonably have known at the time of acquisition or receipt of the goods that these goods had been brought into the customs territory in violation of the regulations. The import duties incurred may only be assessed within a period of three years from the date on which the customs debt was incurred. This period can be extended to ten years if the customs debt is associated with a criminal offence (e.g. tax evasion). These provisions also apply to import VAT."

Delivery and purchase of new vehicles in the EU

While we have mainly dealt with the VAT aspects of used boats so far, we would like to conclude by clarifying the issue of the supply and purchase of new vehicles for private individuals within the EU. So: What happens for tax purposes, for example, if I buy a new boat in Holland and have it delivered to Germany?

This process is referred to as an "intra-Community acquisition". A special case of intra-Community acquisition is the acquisition of "new vessels", to which very special regulations apply. We first need to know which watercraft are considered "new" for tax purposes. A watercraft is new if

- it is longer than 7.50 metres;

- the first commissioning was no longer than three months ago;

- it has not travelled more than 100 operating hours on the water if it was commissioned a long time ago.

In contrast to the supply of other goods, the country of destination principle applies without restriction under tax law to the supply of new vehicles defined in this way. This means that every delivery of a new vehicle to another EU country, even by non-entrepreneurs, is tax-free in the country of the supplier.

Accordingly, the purchaser, even if he is a private individual, must pay tax on the purchase of the new vehicle in his country of residence. This is done by means of a tax return, which the buyer must submit to the tax office responsible for him within ten days of the purchase (individual vehicle taxation in accordance with Section 16 (5a) and Section 18 (5a) of the German Value Added Tax Act).

With this regulation, the "average boat buyer" does not necessarily understand why, when buying a new boat up to 7.50 metres in length, it is not taxed in the country of destination (Germany) but in the country of purchase (the Netherlands), even if it is delivered to Germany.

A prankster who hears a whinny ...