BVWW Managing Director Karsten Stahlhut writes of a "full-blown low-pressure area" that is apparently heading towards the industry, after only the first storm clouds were reported a year earlier when Russia invaded Ukraine. "In the meantime," says Stahlhut, "a different picture is emerging."

The "rosy coronavirus times" from an industry perspective are over, the war and its global economic impact are taking their toll. This can also be seen in the general economic conditions.

Key interest rate as high as last seen in 2000

Stahlhut: "The key interest rate seems to be going through a marathon. Twelve months ago, we thought that the key interest rate had reached its temporary high, but today we know better, because in the meantime there have been another four interest rate hikes to a current total of 4 per cent. The last time it was even higher was in 2000." This currently means that the interest rate for boat financing is now at seven per cent for terms of up to 15 years.

According to the Federal Ministry of Economics, economic output also fell by 0.3 per cent in the first quarter of 2023. As there had already been a decline of 0.5 per cent in the fourth quarter of 2022, Germany is by definition in a "technical" recession.

Shipyards' order books still full until the middle of next year

One of the few rays of hope in the current situation is the fact that engines, spare parts and components are finally available again in relatively unlimited quantities and that the shipyards' order books are still well utilised until the second quarter of 2024. However, the number of winners is "very manageable".

Stahlhut: "If you want to look on the bright side, you could say that after a long lean period when there were almost no boats available to buy in Germany, the supply has now returned to pre-crisis levels. Whether gliders, semi-gliders, displacement boats, motor or sailing yachts, new or used boats, you can currently find all types on offer at dealers again."

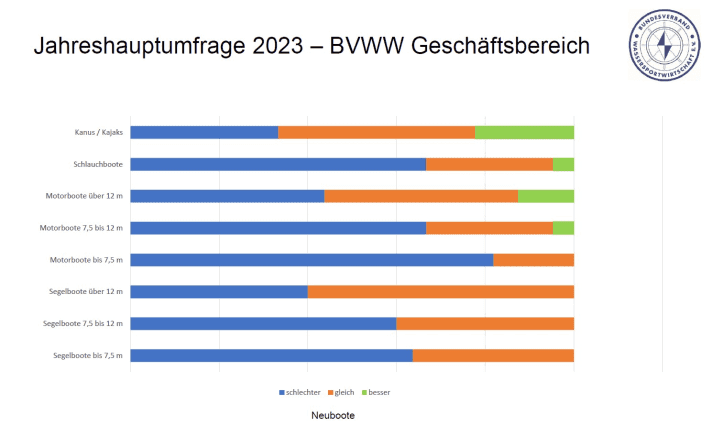

The bad news: there is no boat class that is currently performing as well or even better than last year. All boat classes and types are currently in a worse position than in 2022.

The small motorboat segment is particularly weak

In the case of entry-level boats up to 7.50 metres, 82 percent of the companies surveyed stated that sales were down on the previous year. For motorboats up to 12 metres, the figure was still 67 per cent and for motor yachts over 12 metres it was still 44 per cent.

The trend is similar for sailing boats, with one difference: there has been no feedback in any size class that business is currently better than in the previous year. Not even in the largest class over 12 metres.

Acquisition costs for sailing yachts up 40 per cent

Stahlhut: "This is certainly partly due to the fact that the majority of sailing yachts are purchased for the charter market, which is rarely the case with motor yachts. However, if these sailing yachts are suddenly 40 per cent more expensive to buy than 18 months ago and you are not able to pass on the increased acquisition costs to the weekly charter prices, there is sometimes a large financing gap and the usual return "sails" away." At the same time, there is once again an attractive interest rate for cash assets. Both factors are apparently causing the market to dry up, which could have major and as yet unpredictable consequences, warns the association's managing director.

Nevertheless, at least everything is the same for sailboat charterers. There were hardly any upward or downward deviations compared to the previous year.

Sailing and motorboat training should be intensified

Sailing and motorboat schools, which have seen a decline in the number of course participants, should take note. It is true that 2021/2022 were record years for the training companies and, in this respect, there are now only signs of normalisation. "But," says Stahlhut, "training is the beginning of the entry into water sports, so activities should be intensified again in order to inspire new customers."

According to the BVWW, however, things are looking good for the service companies and marinas. Both sectors still have their hands full, with little to no gaps in order books and berth lists. The only cause for concern here is the shortage of skilled labour.

Prices continue to rise, investments decline

What unites many across all sectors is apparently the price trend. According to the survey, 75 per cent of companies reported higher sales prices (previous year: 78%), while 65 per cent (previous year: 55%) were not satisfied with their company's profit situation. As a result, the willingness to invest has decreased by 10 percentage points in the current year: from 30 to just under 20 per cent of the companies surveyed. A similar trend can be seen in the area of human resources. While 50 per cent of the companies surveyed still wanted to hire new staff in 2022, this figure is now only 40 per cent.

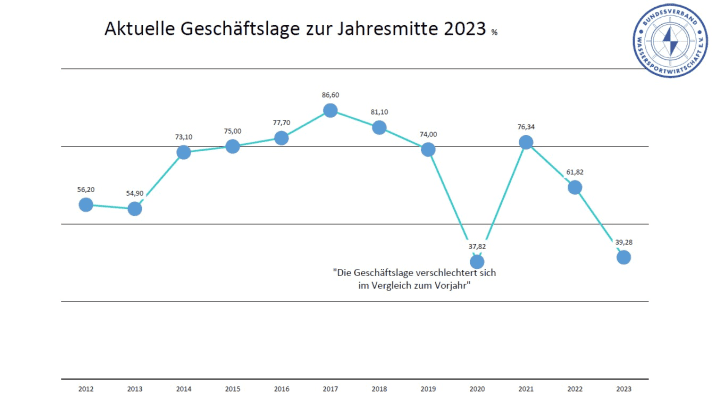

"In summary, it can be said that only just under 20 per cent of the BVWW companies surveyed now rate the current business situation as better than in the same period in 2022, when this figure was still at 40 per cent. The decline in euphoria, which was already evident this time last year, is increasingly being confirmed and is now also reflected in the figures," says Karsten Stahlhut.

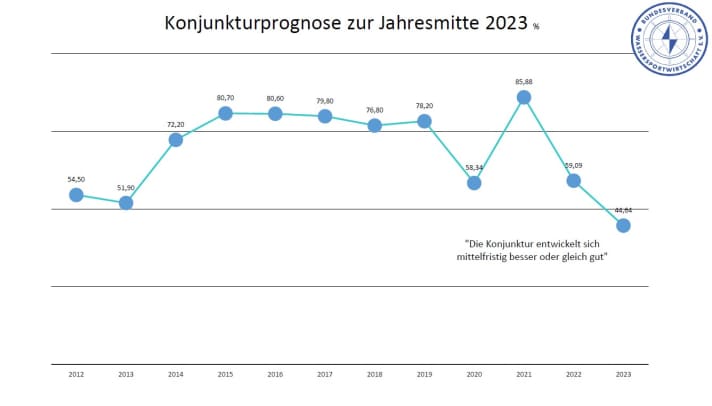

In line with the current situation, the economic forecast continues to march downwards: Only just under 44 per cent of BVWW companies expect a positive or at least stagnating development in the medium term. In the previous year, this figure was still just under 60 per cent.