VMWD economic barometer 2025: Water sports industry slowly on the upswing again

Fabian Boerger

· 17.01.2026

- Cautious upward trend in the water sports industry

- New boats: mid-range increases, entry-level segment stagnates

- Used market: Stable demand at a high level

- Services: Service and charter carry the industry

- Framework conditions: Costs, personnel, social change

- Forecast: cautious optimism for 2026

The storm seems to have passed for the time being and the pessimistic mood has faded: After turbulent years, the industry is finding firmer ground under its keel again. This is according to the latest economic barometer from the German Maritime Industries Association (VMWD) for 2025. Despite the weak overall economy in Germany, the water sports industry proved to be significantly more stable last year than in the year before.

Cautious upward trend in the water sports industry

According to VMWD, almost 38 per cent of the companies surveyed rated their business situation as unchanged and stable - compared to 24 per cent in the previous year. The proportion of negative reports fell noticeably. In 2024, the industry was still under considerable pressure: Stagnating economic growth, unsatisfactory interest rate trends and, above all, the threat of thousands of industrial jobs being lost weighed on sentiment. The VMWD barometer has now confirmed with figures what was already being heard in the industry in autumn: The curve is rising again with the year 2025, albeit only gently.

What is the economic barometer?

For the economic barometer, the German Maritime Industries Association the industry companies on the basis of 18 questions. These range from a general assessment of the economic situation and sales trends to the condition of the waterway infrastructure and the potential development of boat sales prices. The answers are incorporated into the five segments of the barometer, making it an important sentiment indicator for the maritime leisure industry.

New boats: mid-range increases, entry-level segment stagnates

A clear division emerged in the new boat segment. Very small sailing boats and entry-level models remained stable, while medium-sized and large boat classes recorded noticeable growth. Remarkable: Sailboats between 7.5 and 12 metres are experiencing a trend reversal. The proportion of companies with improved sales rose from five to almost 20 per cent in 2025. In 2024, companies were still reporting declining or at best stable sales.

In contrast, sales of small motorised and inflatable boats remained quiet - stable, but without significant momentum. The VMWD explains this with "the return of high-investment customers in the larger boat segment". Buyers of smaller boats, on the other hand, tend to hold back or switch to the second-hand market.

Used market: Stable demand at a high level

Used boats remained a strong segment of the industry. According to VMWD, negative reports declined across all sizes. What is striking is that over 30 per cent of dealers reported rising sales of large sailing yachts. The reasons: Used boats are immediately available, cheaper and there are no problems with them in terms of delivery times and cost increases.

The market has matured - and its stability has taken on a new quality."

Services: Service and charter carry the industry

The service sectors also proved to be reliable in 2025. More than a third of businesses in the water sports industry stated that they had recorded an increase in turnover, while just under half reported stable figures.

The situation was similar in the charter sector: Sailing, motor and houseboat hire companies reported largely constant results, similar to 2024, while canoe and kayak hire companies even managed to increase their numbers. Schools, harbours and surveyors were also in calm waters and benefited from their relative independence from the economy, according to the association.

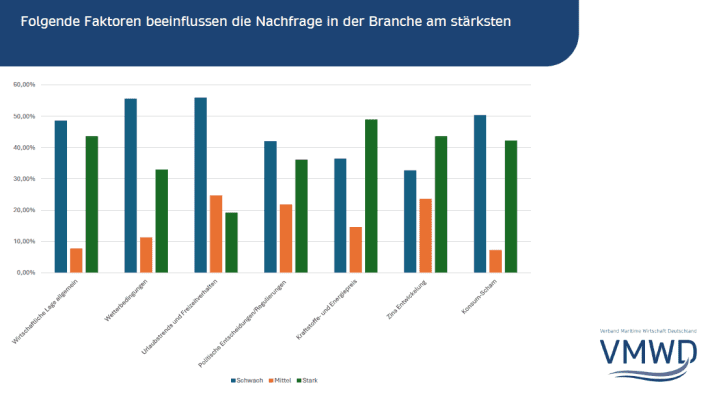

Framework conditions: Costs, personnel, social change

The challenges faced by the water sports industry in recent years have not completely disappeared. Energy prices, high interest rates and the overall economic situation continue to act as a brake. According to VMWD, there is also a new phenomenon: 42 per cent of businesses have noticed "consumer shame" among customers. In other words, potential buyers are exercising greater restraint and paying increasing attention to sustainability. Luxury goods such as boats are thus coming under pressure to justify themselves.

The shortage of skilled labour also remained a problem in 2025. More than a third of companies see this as a key hurdle, followed by a lack of orders and increased operating costs. The association's conclusion: "The industry is struggling less against a lack of demand than against structural framework conditions."

Forecast: cautious optimism for 2026

Almost 40 per cent of businesses expect stable conditions for the coming season - more than in the previous year. In 2024, 37 per cent still expected economic stagnation (2023: 32 per cent). Pessimistic assessments are decreasing, while around a quarter of companies are expecting improvements. The VMWD's conclusion: a boom is not imminent, but for the first time in years, a predictable and calculable year is on the horizon.

The Managing Director of the German Maritime Industries Association, Karsten Stahlhut, says:

"2025 was a stable year. Companies are assuming that retail will pick up a little more momentum in 2026. In the long term, we need to do more to counter demographic change than we are currently doing. To do this, everyone has to pull together."

Fabian Boerger

Editor News & Panorama