2021 was perhaps the best year that shipyards, outfitters, accessory dealers, ship brokers, charter companies on German inland and coastal waters and local marina operators have experienced so far. During the coronavirus pandemic, Germans flocked to the water in droves. Everything that was afloat was bought. The used boat market was empty, new yachts were no longer available at short notice and the harbours were full to capacity.

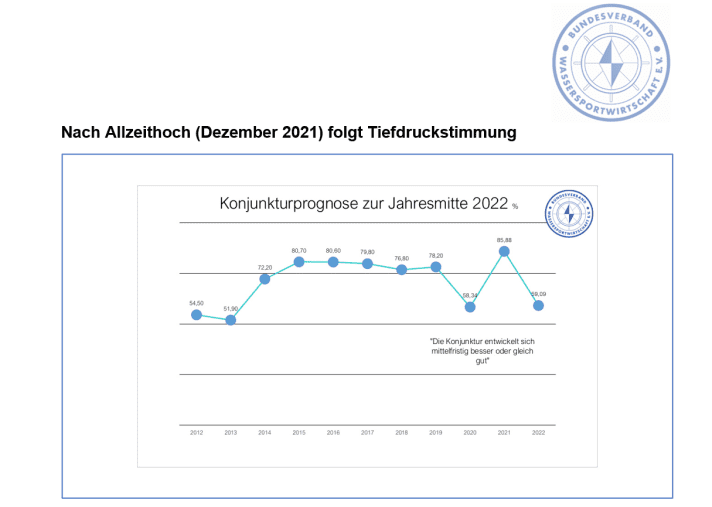

The mood in the industry was correspondingly euphoric in the middle of last year. Many thought that things would continue in the same way or even better. The curve depicting the economic forecast - which is surveyed every year by the German Water Sports Industry Association among its member companies - soared to unprecedented heights after the lockdown year of 2020. Almost 86 per cent of boat builders, dealers and outfitters were optimistic about the future.

That has changed dramatically. On Wednesday, Karsten Stahlhut, Managing Director of the Federal Association of the Water Sports Industry (BVWW) presented the latest figures at a press conference in Hamburg. According to the figures, the mood in the industry is in the doldrums again. Only 59 per cent, the same proportion as in the crisis year 2020, believe that the economy will develop better or at least as well as this year in the medium term. The last time the mood was worse was in 2012 and 2013 (see chart).

In addition to the coronavirus pandemic, the situation for large parts of the German and international economy is overshadowed by the war in Ukraine and the associated inflation, rising energy prices and rising interest rates. The boat industry had already suffered from the shortage of raw materials and supplies caused by the temporary disruption to supply chains.

"Everything you need to build a boat is missing"

All of this has different effects on the individual segments of the boating industry. Stahlhut describes it as follows: "The current mood within the water sports industry is not bad, but it is no longer euphoric. The situation is simply strange. On the one hand, boat builders' order books are fuller than they have been for a long time, and waiting times between ordering and delivery of boats are at an all-time high. On the other hand, manufacturers cannot keep up with production. There is a shortage of everything. While the pandemic has already had a major negative impact on the global market situation for the flow of goods, the last lockdown in China and now the war in Ukraine have caused many supply chains to collapse completely."

Whereas this time last year it was mainly engines that were in short supply, there is now a shortage of everything you need to build a boat, says Stahlhut: cleats, discs, fittings, electrical components, heaters - the list seems to go on and on. "At least the good thing about it is that new suppliers are being sought and sometimes found and that the range is being diversified. However, it remains to be seen whether the quality can always keep up," says Stahlhut.

On the consumer side, fear of the general price increase is also spreading. This is now being felt first by suppliers of smaller boats. The motorboat segment up to 20,000 euros is particularly affected. While these boats were literally being snatched out of dealers' hands recently, they are now finding fewer and fewer buyers. Karsten Stahlhut: "This is due to the general uncertainty, especially among young families, who currently don't know whether they will be able to cope with energy costs and general inflation." The general reluctance to spend is therefore also having an impact on water sports.

"For the larger boats, the fuel price obviously only plays a subordinate role"

In the larger motorboat classes, on the other hand, the situation looks somewhat more positive, according to the official BVWW statement: "There is still good, solid demand here. In this segment, it apparently makes no difference whether the yacht costs 300,000 or 350,000 euros. The increased price of fuel also seems to play a subordinate role here. Overall, around 65 per cent of companies consider the situation to be better or at least at the same level as last year.

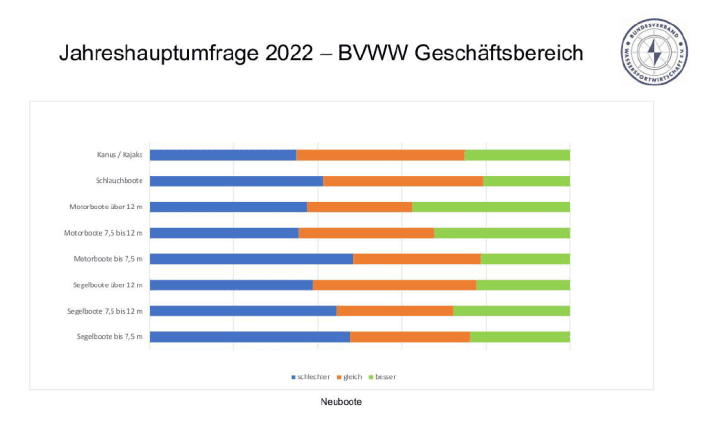

The demand for sailing boats shows similar trends. The larger the yachts, the greater the current demand appears to be. The largest class from 12 metres upwards also has at least a neutral (39%) or positive (22%) assessment of the current business situation (see chart).

Sailing schools and boat service companies were also on the upswing. After the boom year of 2021, charter companies based in Germany returned to something like normality in the past season. As people were allowed to travel again, namely fly, charter destinations abroad were also accessible again. However, diving suffered the most. Many diving centres abroad had to close during the pandemic, and this water sports segment has not yet recovered.

"Manufacturers and retailers must once again invest significantly more in the success of their business"

"Summarising across all sectors, it can be said that almost 40 percent of BVWW companies still rate the current business situation as better than in the same period in 2021. Nevertheless, there has been a decline in euphoria. The many global events are dampening the mood," summarises Stahlhut. He adds: "After the industry benefited greatly from the pandemic in the last two years and customers bought on their own, manufacturers and retailers will have to invest significantly more in the future to ensure the success of their business.

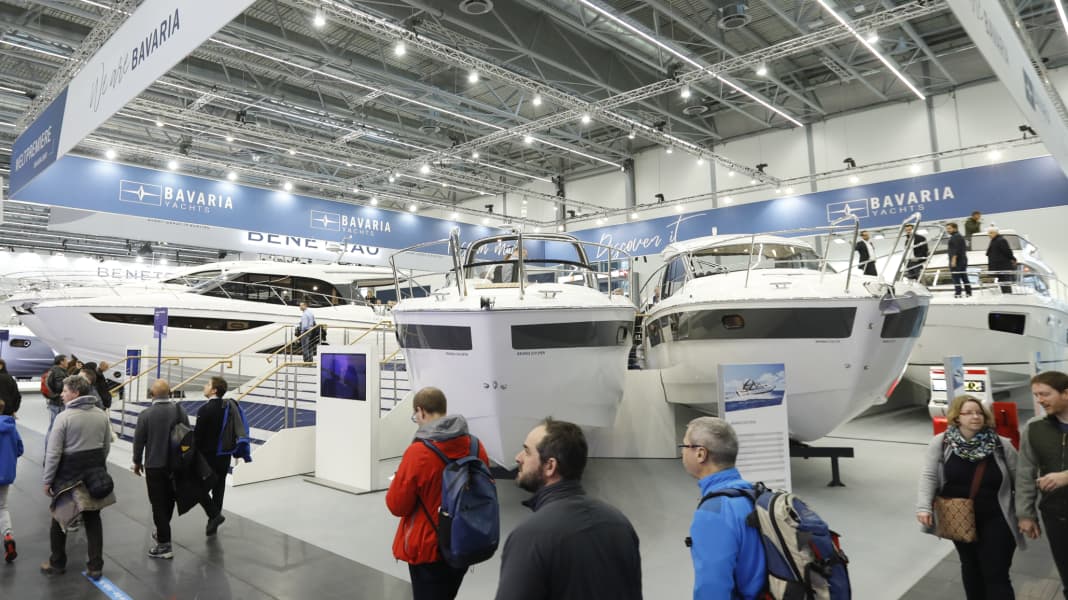

This development will be reflected in very concrete terms as early as January, when the Boat show takes place. The prospects for the world's largest water sports exhibition on land are rosy. The halls are almost fully booked, the hygiene concept is mature and tried and tested, the energy supply is secure, the admission prices are at the same level as two years ago and there are a large number of innovations - as a visibly satisfied boot Director Petros Michelidakis said at the press conference in Hamburg.

The quarrels caused by the cancellations of boot in previous years seem to have been forgotten, and the motorboat manufacturers in particular are apparently beating down the Düsseldorf hall gates. "The trade fair is excellently booked, we have waiting lists in the motorboat sector and we have had to ask individual exhibitors to release parts of their stand space for other exhibitors," reported Michelidakis. The increased demand for large, voluminous and luxurious motor yachts has been taken into account with a new hall layout. For example, there will be a Superboats Hall (Hall 5) for the first time in 2023.

The rush is not quite as great among the sailboat and sailing yacht manufacturers. Two well-known shipyards, Hanse and X-Yachts, are currently not exhibiting in Düsseldorf. However, they are still in talks, according to the boot director. And it is also questionable whether the other sailing boat exhibitors will come with the usual number of boats. Michelidakis was unable to answer a corresponding enquiry. According to YACHT information, however, at least a few shipyards will not be present in Düsseldorf with the usual number of boats.

Wally comes to boot with a sailing yacht for the first time

However, Michelidakis also has a great surprise for the sailors, which might prompt one or two of them to visit the trade fair: Wally will be exhibiting a sailing yacht on the Rhine for the first time. A 37-foot Wally Nano will be on display in Hall 16. In total, however, sailing boats will only fill Halls 15 and 16 next year.

The neighbouring Hall 17 becomes a surf spot. As the "wave", the pool where you could surf, will no longer be there and Hall 8a in front of the north entrance will no longer be used, the surfers needed a new home. And that's what they got, including a new, huge water basin and lots of wind machines. Because: at boot, the surfing trend sports of wingsurfing and foiling are clearly in the foreground. This requires a strong breeze.

There are also some other changes to the hall layout. The hall plan shows what can be found where in the coming year.

Petros Michelidakis emphasises that despite the elimination of the halls in front of the north entrance, the same amount of space will be occupied by exhibitors in 2023 as in 2020. Only a few exhibitors from previous years have definitely cancelled their participation. It was also important for him, Michelidakis, to point out that Ukrainian companies will be keeping space free until the very end. Many companies, including boat manufacturers, were destroyed during the war.

Another new feature in Düsseldorf is the Blue Innovation Dock. This is a forum and a stage to promote and present sustainability ideas and projects in water sports. And to exert political influence, preferably at European level.

Finally, Petros Michelidakis pointed out that the company had done its homework in terms of energy supply. Exhibitors need not fear any additional charges due to rising electricity prices. The trade fair's electricity contracts had been concluded on a long-term basis. The same applies to the gas supply for the trade fair. The trade fair's own power plant can also be converted to oil if required, and the halls will be heated as usual. And, as always, at 18 to 19 degrees, nothing will change. As in previous years, the crowds and the spotlights will ensure that temperatures rise automatically.

The boot boss is also relaxed about the current rise in coronavirus infection figures. All halls have been equipped with air filters. According to him, they work so well that it will no longer even be necessary to open the hall doors for ventilation in future.

Last but not least, trade fair visitors can buy their tickets at the usual conditions. Ticket prices will not increase, with the exception of on-site purchases at the trade fair box office.

boot will take place from 21 to 29 January 2023 and around 1,500 exhibitors are expected to showcase their products in 16 halls.